You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to List

Due to the ongoing situation with Covid-19, we are offering 3 months free on the agent monthly membership with coupon code: COVID-19A

UNLIMITED ACCESS

With an RE Technology membership you'll be able to view as many articles as you like, from any device that has a valid web browser.

Purchase AccountNOT INTERESTED?

RE Technology lets you freely read 5 pieces of content a Month. If you don't want to purchase an account then you'll be able to read new content again once next month rolls around. In the meantime feel free to continue looking around at what type of content we do publish, you'll be able sign up at any time if you later decide you want to be a member.

Browse the siteARE YOU ALREADY A MEMBER?

Sign into your accountNAR Study Shows Lack of Affordable Housing Biggest Obstacle to Home Buying

April 12 2022

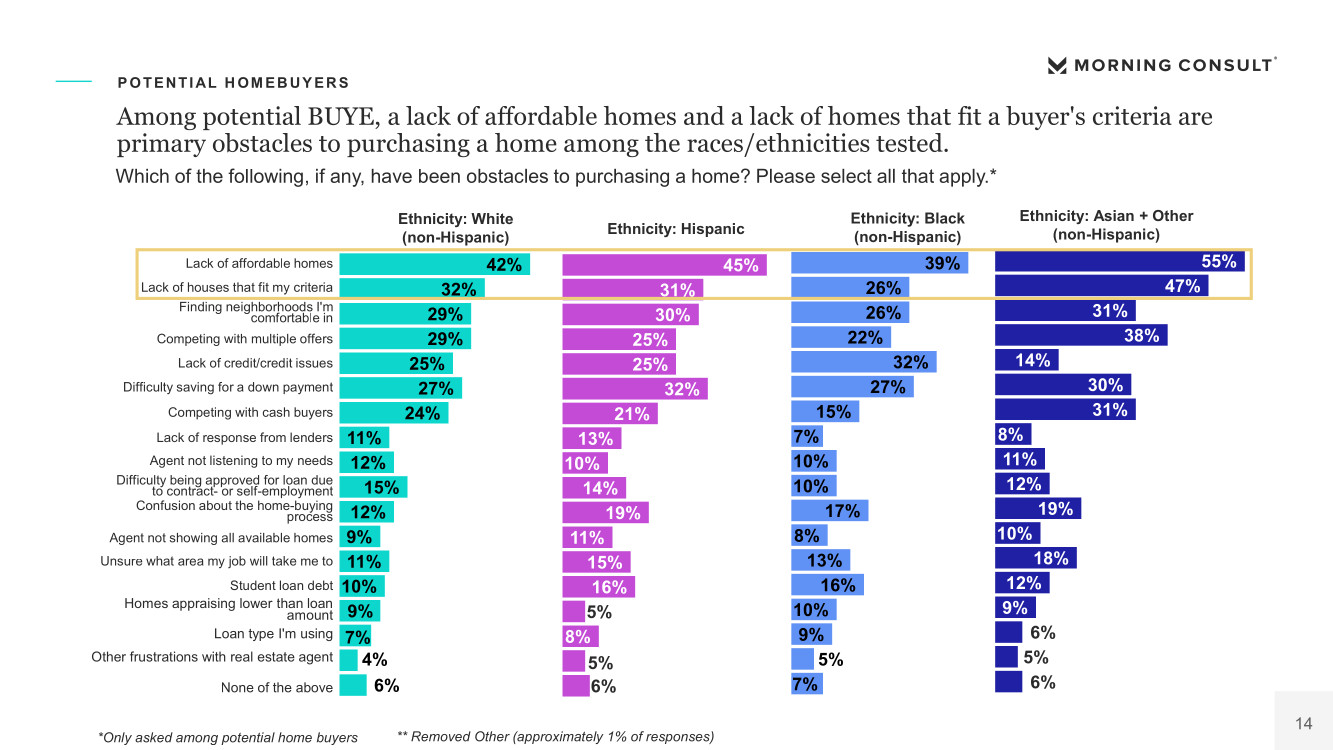

The lack of affordable homes is the top obstacle holding back potential home buyers of all races, but other obstacles to homeownership varied by race/ethnicity according to a new report released by the National Association of Realtors®. NAR partnered with Morning Consult for its latest study, 2022 Obstacles to Home Buying, which explores current obstacles to home buying broken down by race/ethnicity.

The report compares the experiences of both potential and successful home buyers across races and ethnicities. The biggest challenges identified are a lack of affordable homes, a lack of homes that fit their criteria, competing with multiple offers, and saving for a down payment.

"Record-high home prices and record-low inventory have made the home buying process exceedingly difficult," said Dr. Jessica Lautz, NAR vice president of demographics and behavioral insights. "Our new study shows that while the inventory crisis is affecting potential buyers of every race, nearly all home buyers agree that homeownership is still an important part of the American Dream."

The findings show the second-ranking obstacle faced among potential Hispanic buyers was difficulty saving for a down payment. For potential Black home buyers, lack of credit or credit issues was the second-highest concern, while for White and Asian potential buyers it was a lack of homes that fit their criteria.

"In the current hot market, people who have traditionally enjoyed homeownership can capitalize on those gains to realize new opportunities. Meanwhile, the market becomes increasingly unaffordable, and the obstacles greater, for those trying to enter the market," said Bryan Greene, NAR vice president of policy advocacy. "NAR advocates not only for existing homeowners, but also for those aspiring homeowners whose entrance into the market is necessary for the economy to thrive."

Approximately three-quarters of potential home buyers are currently planning to save for a down payment, which most noted will take between six months and three years.

Among buyers who were successful in attaining homeownership, the new report found Asian respondents (51%) were more likely than White (32%), Hispanic (35%), or Black (33%) respondents to say a lack of affordable homes was an obstacle in their home purchase. The second-biggest obstacle White and Asian buyers faced was competing with multiple offers, while for Black buyers it was finding neighborhoods in which the buyers were comfortable.